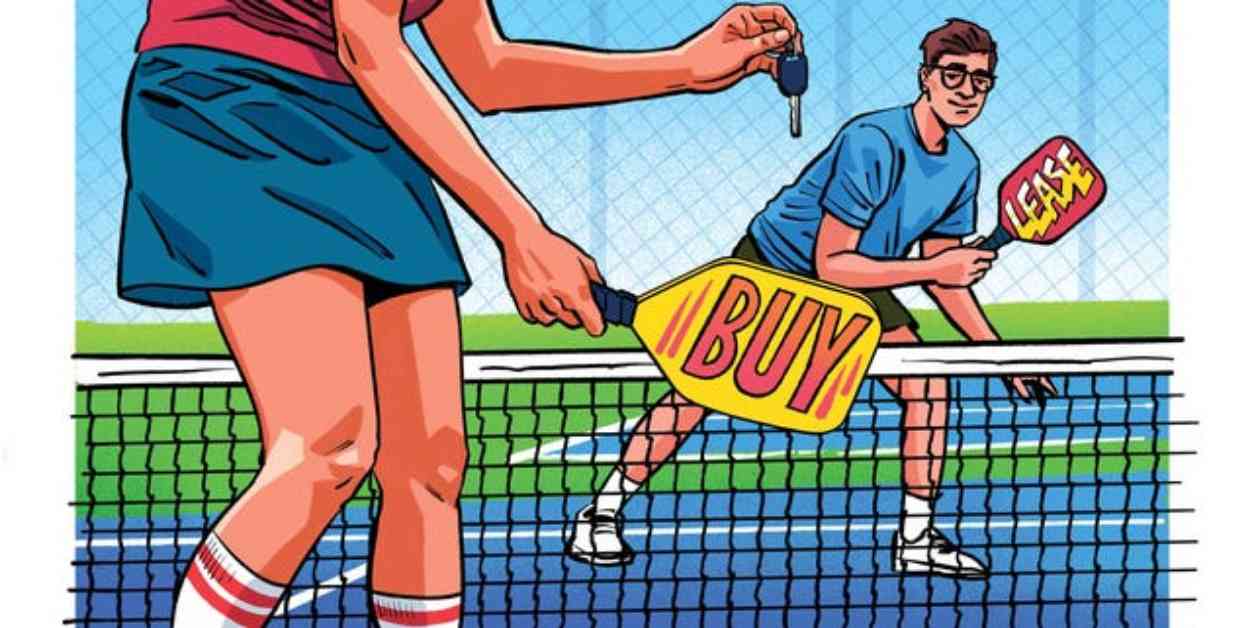

Car Financing and Leasing: Essential Tips and Considerations for Buyers

Car shopping can be a daunting task, with numerous decisions to make along the way. One of the first questions to ponder is whether to finance or lease a vehicle. Each option has its pros and cons, so it’s essential to weigh them carefully before making a decision. Financing a car is a good choice if you plan to keep the vehicle for an extended period. It allows you to spread payments over many years, giving you the freedom to do whatever you wish with the car once it’s paid off. Whether you want to keep driving it, sell it, trade it in, or even turn it into a track-day project, the choice is yours. One key advantage of financing is that you can drive the car as much as you want, unlike leases that come with mileage restrictions and overage charges.

Leasing: A Different Approach

Leasing, on the other hand, can put you in a nicer car for a similar monthly payment. While this may sound appealing, it’s important to consider that at the end of the lease term, you have to return the vehicle, leaving you with nothing but memories. However, leasing has its perks too. There’s less guesswork about costs over the lease term, offering mental and financial relief. Lease agreements often include a buyout option, allowing you to purchase the car at a predetermined price if you’ve grown attached to it or if your financial situation has changed.

Borrowing Smart: Understanding Your Options

When it comes to financing, there are various avenues to explore. Captive financing, offered by auto manufacturers through their lending arms, often presents special deals with lower APR rates than traditional lenders. However, be cautious of dealership lending, where you might end up with higher interest rates than expected. To avoid this, consider getting pre-approved for a loan from your bank or credit union before visiting the dealership. Used-car rates can also vary depending on the vehicle’s age, so it’s crucial to shop around and negotiate for the best deal.

Long-Haul Loans and Credit Concerns

While some lenders offer extended loan terms up to 84 months, it’s essential to consider the long-term costs and potential maintenance expenses. Additionally, if you have bad credit, you might face higher interest rates, making the car purchase more expensive. Working to improve your credit score before buying a vehicle or getting a co-signer can help secure better financing terms.

In conclusion, car financing and leasing require careful consideration and research to make an informed decision. By understanding the various options available and being aware of potential pitfalls, you can navigate the car-buying process with confidence and secure the best deal for your needs and budget.