China’s Robot Makers Racing to Develop Humanoid Workers for Tesla

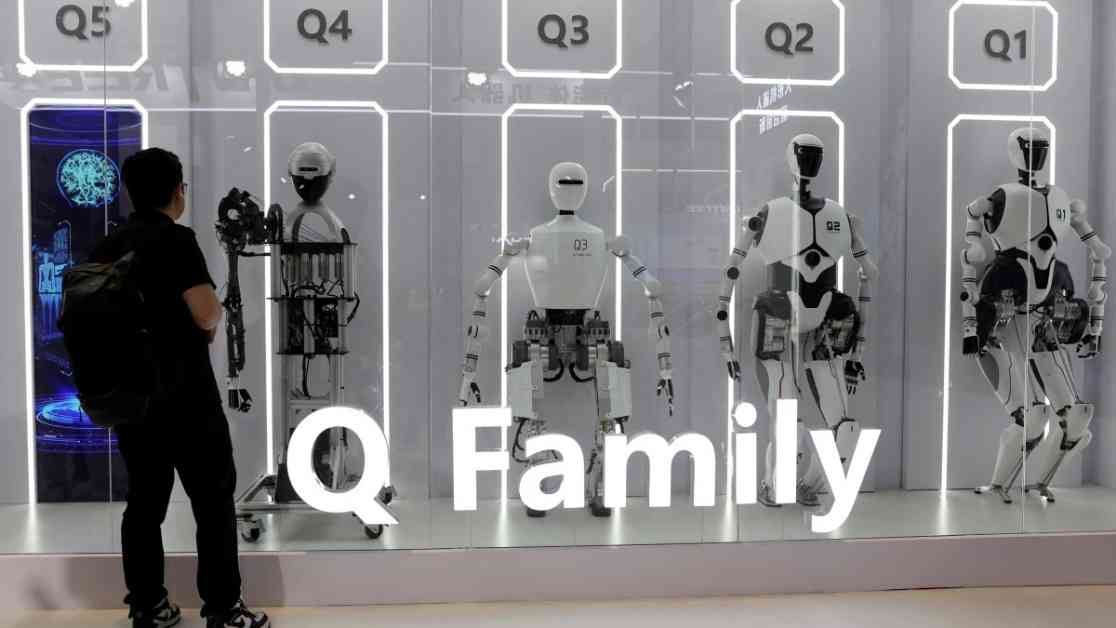

China’s dominance in the market for electric vehicles is undeniable. Now, the country is setting its sights on Tesla in a race to develop battery-powered humanoid workers that are expected to replace human workers on assembly lines building EVs. At the recent World Robot Conference in Beijing, more than two dozen Chinese companies showcased their humanoid robots designed for factory and warehouse work, with even more exhibiting the precision parts needed to build them.

China’s push into the emerging industry draws on the successful formula behind its initial EV drive over a decade ago: government support, fierce price competition from a wide array of new entrants, and a robust supply chain. Arjen Rao, an analyst at China-based LeadLeo Research Institute, noted, “China’s humanoid robot industry demonstrates clear advantages in supply-chain integration and mass production capabilities.”

President Xi Jinping’s policy of developing “new productive forces” in technology has also played a significant role in propelling China’s robotics efforts. Brochures for the recent event at the World Robot Conference emphasized this commitment to technological advancement.

Beijing and Shanghai have both made substantial investments in the robotics industry. Beijing launched a $1.4 billion state-backed fund for robotics in January, while Shanghai announced plans to establish a $1.4 billion humanoid industry fund. These initiatives underscore China’s commitment to fostering innovation and technological development in the robotics sector.

The robots unveiled at the conference this week draw on the expertise of domestic suppliers who previously rode the wave of the EV industry, including battery and sensor manufacturers. With the annual global market for humanoid robots projected to reach $38 billion by 2035, according to Goldman Sachs, the potential for growth and expansion in this sector is immense.

Hu Debo, CEO of Shanghai Kepler Exploration Robotics, a company inspired by Tesla’s humanoid robot Optimus, highlighted China’s specialization in rapid iteration and production. Hu’s company is currently working on its fifth version of a worker robot for factory trials, with an expected sales price of less than $30,000.

The “catfish effect” of Tesla’s presence in China’s EV industry has also extended to the robotics sector. When Tesla introduced its Optimus robot in 2021, CEO Elon Musk emphasized its potential significance, likening it to the importance of the vehicle business over time. This move by Tesla has spurred Chinese companies to innovate and compete in the development of humanoid robots.

Tesla’s Optimus robot, based on an artificial intelligence approach similar to its “Full Self-Driving” software for EVs, has garnered attention for its cutting-edge technology. While Tesla may have an early lead in AI, Chinese competitors are focusing on driving down production costs to increase market competitiveness.

At the World Robot Conference in Beijing, Tesla showcased Optimus alongside a Cybertruck, drawing crowds of people eager to see the latest advancements in robotics technology. Despite the impressive display of Chinese humanoid robots demonstrating various capabilities, Optimus remained a popular exhibit, indicating the interest and potential for growth in this sector.

UBTECH Robotics, a Hong Kong-listed company, has been testing its robots in car factories, including Geely and Audi plants in China. Sotirios Stasinopoulos, UBTECH’s project manager, expressed optimism about moving towards mass manufacturing by next year, with the goal of deploying up to 1,000 robots in factories.

While the current generation of production robots has been led primarily by companies outside China, such as Japan’s Fanuc, Switzerland’s ABB, and Germany’s Kuka, owned by Chinese company Midea, China is making significant strides in factory-installed production robots. The country leads the world in the number of production robots installed in factories, surpassing North America by a wide margin.

Xin Guobin, China’s vice-minister for industry and information technology, highlighted China’s role as a key player in the global robot industry, emphasizing the country’s commitment to technological advancement and innovation. Despite ambitious goals for mass production of humanoid robots by 2025, transforming EV production on a large scale will take time and considerable investment.

LeadLeo Research Institute’s Rao predicts that it will likely be 20 to 30 years before humanoid robots can achieve large-scale commercial application. As China continues to invest in robotics technology and innovation, the future of humanoid workers in factories may not be as far off as it seems. The race to develop advanced humanoid workers for the automotive industry is well underway, with China poised to play a leading role in shaping the future of manufacturing.